What are the differences between HMO & PPO Networks on Private Health Insurance?

You have probably heard about HMOs, PPOs and other acronyms when it comes to health insurance. Identifying the differences between the various networks available can be a bit challenging.

Although the importance of health insurance cannot be overstated, the idea of having to work through the various options available can be daunting.

Most people wonder what these acronyms mean, the differences between them and most importantly, which one is the better option when choosing an insurance plan.

In this article, we shall break down HMO and PPO networks, considering their differences and everything else you need to know.

Table of Contents

What is an HMO network?

HMO stands for health maintenance organization. An HMO network offers a group of healthcare providers who have settled for providing medical services at prices lower than what is negotiated by an insurance company.

If you are a member of an HMO, you get to choose a single physician from a provided list of approved healthcare practitioners. However, an HMO member is only permitted to see a specialist such as a cardi or am obstetrician if they are referred by their PCP ( Primary Care Physician)

Depending on the insurance plan and company, the benefits and services offered by an HMO can differ. Some plans may cover laboratory tests, cancer screenings, X-rays, prescribed medications and others. Typically, an HMO plan also offers pre and post-natal care, factoring in the newborn.

The main idea behind an HMO is making healthcare services readily available. This will prompt patients coming to the hospital early enough to prevent minor conditions from becoming severe.

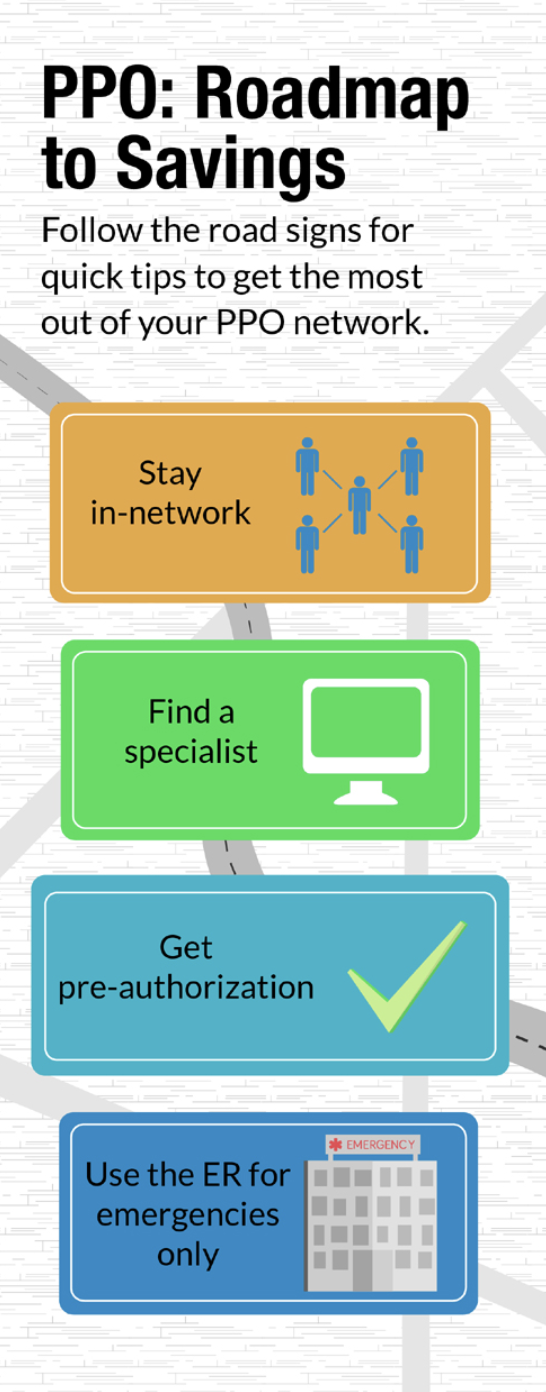

What is a PPO network?

PPO stands for preferred provider organization. A PPO network offers healthcare practitioners that afford its member’s multiple choices regarding healthcare providers and healthcare in general.

Unlike HMOs, PPOs allow their clients to receive care from their preferred physicians. It does not restrict patients to receiving medical care from in-network health providers.

With a PPO, the designation of a primary care physician (PCP) is optional, and patients have the liberty to make appointments with healthcare providers directly. PPO patients, unlike in an HMO network, patients do not require referrals.

On most occasions, PPO network plans offer lower costs for services gotten from providers and better benefits that beneficiaries are encouraged to use. With PPO, however, members can still receive outside care, even though they might pay for it.

PPO affords patients access to a more extensive network of healthcare providers and specialists. Its broader coverage allows patients to seek more comprehensive health care services, with the assurance that their insurance plan has them covered.

What are the differences between an HMO network and a PPO network?

HMO networks and PPO networks are the most popular types of medical health insurance plans. However, these two plans differ in several ways.

An HMO is typically the cheaper option; however, you are only covered in your county. The network also has much higher deductibles, and only a few doctors will take the plan.

PPOs, on the other hand, usually have a name brand – such as carriers like Blue Cross, United or Cigna. This plan will pay claims in and out of the network, so you are covered no matter where you are.

There are several differences between the two networks, some of which include:

Size of the provider network

For most families and individuals, the main difference between HMO networks and PPO networks is the primary care doctor.

HMO networks require that you and your family have a primary care doctor who refers you for most medical services. To see a specialist, you will need to go through your PCP, resulting in an extra visit to the hospital.

The upside is that most times HMO plans offer lower premiums, but the truth remains – every plan is different.

For individuals or families that do not want to pass through a primary care doctor before gaining access to other medical services, making a decision is relatively easy.

Cost Analysis

PPOs give you flexibility and freedom of choice for higher premiums than HMO’s. However, HMOs have lower premium costs while offering no coverage outside their network.

Receiving claims

HMO networks make payments to health providers directly, eliminating the need for patients to file claims.

With PPO networks, however, patients may have to file reimbursement claims after first footing the bills when they visit out of network providers.

Range of services covered.

Although the range of services covered by both networks depends on the insurance company and the plan taken, they are mostly similar. The only difference being that HMO plans may not be available in certain states.

Dental Care

Dental care for HMOs and PPOs work similarly to general health care policy under these plans.

With HMOs, a primary care dentist is usually required. The plan offers low out of pocket expenses, maintaining the “no coverage outside network” policy.

PPOs allow patients to visit out of network dentists at extra charge.

Prescriptions

Pharmacy locations, like the coverage under an HMO, are restricted to a network. Patients can get their prescriptions filled and covered at specified locations while under the plan.

With PPOs, patients can fill a prescription wherever they want; however, they have to incur additional charges when using out of network pharmacies.

Referrals and PCPs

When under an HMO plan, patients need to have a referral from their PCPs to be able to see a specialist. Although exceptions are made in emergencies, this is usually the practice.

PPOs, on the other hand, will allow members to visit any healthcare provider under the company’s network, even specialists without a referral.

Suppose you have a condition requiring regular visits to specialists. In that case, a PPO is a preferable option due to the absence of referrals and fewer restrictions on seeking providers out of network.

With PPOs, patients can decide to visit in-network specialists whenever they feel like without requiring any referrals from PCPs. In a PPO network, having an assigned PCP is optional, unlike HMOs where it is mandatory.

Deductibles and Copay

While HMOs do not usually have a deductible or have low deductibles, they require a copayment for non-preventive visits.

PPO plans also have copayments on non-preventive medicals, but they also offer annual deductibles and higher premiums.

Which is the better option?

The choice of which is a better option is mostly dependent on the personal preference of individual customers. Deciding what network to go with is based on your expected or current health needs.

It would be best if you looked beyond low premiums as with time; you might require a plan that offers more flexibility, such as a premium at a later date.

When choosing between an HMO and a PPO insurance plan, you should consider the following:

- Cost of premiums

- Out of pocket costs

- Requirements for specialized medical care

- How important a primary care provider is

What you need to keep in mind is that HMOs are more affordable than PPOs while PPOs are more flexible, offering you freedom of choice.

Although statistics show that more people signed up for PPO network plans, HMO network plans have been shown to draw better customer satisfaction ratings.

Choosing between an HMO network and a PPO network is a matter of weighing the cost and convenience options.

Before settling on a plan, make an effort to review a list of in-network providers situated where you live. You should also have a budget and a realistic measure of your income. Analyze the HMO availability where you live and determine if you will require any visit to a specialist in the coming year.

Private Health Insurance on a Name Brand Nationwide PPO Network is Always the Best Option

When selecting your health plan, your decisions should be based on your approach to healthcare and lifestyle.

HMO and PPO networks are designed to suit patients with different needs so ensure that you speak with an expert before choosing a preferred setup.

Carefully consider your options and needs before you decide on a network. There is no rush, and you should carefully weigh the provisions made by each plan before proceeding with payments.